Much like corporations and charity organizations, condos, co-ops and HOAs across the nation are helmed by groups of residents who volunteer to serve their communities, and who are elected to their post by their neighbors. This is of course the case across Chicagoland, where talented individuals of every description regularly volunteer for board positions in hopes of serving their communities.

While many of these folks are either currently working in or have perhaps retired from successful, demanding careers, there are many situations in which an HOA's board of directors may need an expert’s advice in law, finance, or corporate administration. Illinois state laws and association laws in particular, vary from other states as well. This overall lack of specific experience or knowledge may lead a perfectly well-meaning board to make a decision with serious legal ramifications, putting the board at risk for lawsuits both within and outside the community.

Avoiding Legal Blunders

What is the best way for a board to avoid a legal foul when deciding on a course of action for the community? Founding Partner David Hartwell of the law firm of Penland & Hartwell LLC in Chicago recommends a few things. “First of all, board members should be compelled to read their declaration and bylaws all the way through at least once,” he says.

“Understanding what the rules of the road are is going to be extremely helpful in not making bad decisions. A lot of times what happens is boards get an idea in their head, and they get married to that idea. And when they find out that trying to make that thing happen is inconsistent with the bylaws or Illinois state law, they still try to push it through in some way. Illinois state law says that adhering to your fiduciary duty as a board member is closely adhering to the governing documents of the association.”

Lawyers say that ignorance of the law is no excuse. “The best way to avoid a legal mistake is to be in contact with your attorney and have a discussion about every nonstandard or ordinary action not taken,” says Marshall N. Dickler, a principal with the law firm of Dickler, Kahn, Slowikowski & Zavell, Ltd. in Arlington Heights. “Maybe even discuss ordinary activities that have contracts and renewals.”

It's Not Personal

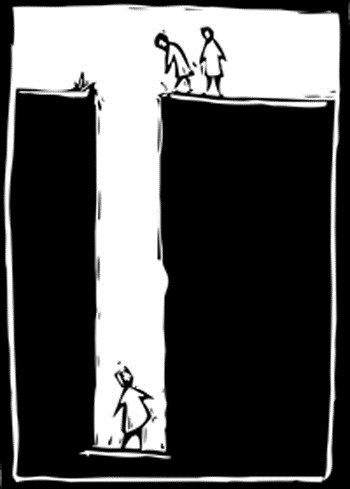

Boards also have to recognize that emotions have no place in the decision-making process. Selective enforcement of the rules might become a legal issue. One attorney recalled an incident when a board decided to exclude a particular service at community expense. An amendment was drafted and incorporated into the community documents. When a resident required the service, and the document was presented, it was discovered it had never been signed, and was therefore not valid or legal. A brief review by the community attorney could have prevented the costly oversight.

The rights of the individual members must yield to the rights of the membership as a whole. Because of this, the governing board of the association is empowered to impose and enforce reasonable controls over the use and occupancy of the property. Members simply may not do as they please, Dickler notes.

Rules and regulations, says Dickler, are complicated legal documents. “They should be prepared by an attorney and not written by a property manager or by one of the board members,” Dickler says. “The rules and regulations must be properly and legally adopted and proper notice must be given,” he says.

Following the law is the best course of action for boards of directors, Dickler says. “The most common mistake is to not follow required procedures and not documenting actions legally,” Dickler warns. “If an association has certain rules and procedures in place, such as giving a person being fined a notice and opportunity to be heard before imposing the fine, then they must follow that procedure. Do not just summarily fine someone. Make sure you have a right to do it, or impose other requirements.”

“Another huge error is just signing any contract given to them by a vendor without any review and without any attorney looking at the document,” Dickler continues. “This puts an association at a huge disadvantage, should a project or service be delayed, or if costs exceed expectations. You can avoid liability by following the legal requirements. Use reasonable business judgment.”

“One of the most common mistakes I see boards make is when they try to enact or enforce certain rules that are not consistent with their declarations or Illinois law,” adds Hartwell. “If a board is professionally managed, they should listen to what their manager has to say.”

Damage Control

Of course, honest mistakes are going to happen occasionally, no matter how carefully or conscientiously a board approaches their duties and decision-making. Misinterpretation of community documents and even negligence can be repaired—but the key word here is 'honest.' Don’t cover up your mistakes, lawyers advise.

“Most state laws protect not-for-profit boards and condo boards from ordinary negligence,” says Dickler.

“If boards are professionally managed, they need to rely on their property management teams for issues of procedure,” says Hartwell. “The Illinois Condominium Property Act is quirky. If you don’t do something 100 percent consistent with Illinois procedure, it’s a problem. So if you don’t send the notice out in the right time period, say the right things on the notice, what you are trying to accomplish may all be wiped out.”

Rules and regulations must be reasonable, says Dickler. “That is, they must have a relationship to the purposes of the association, must not impose excessive burdens, and must be rationally and reasonably intended to and capable of accomplishing the legitimate purposes of the association (such as protecting the health, safety and welfare of the members or protecting the value or attractiveness of the property.) By passing rules and regulations and by enforcing the rules and regulations as well as the covenants of the governing documents, the association can exercise the reasonable controls necessary for collective condominium, townhome, or other community association living.”

Keep it Friendly

Just as most for–profit businesses consult professionals before making big decisions, so should community associations. Experts are available in every field—managers, accountants, insurance agents, and engineers can all supply a wealth of accumulated knowledge. A well-run board will do their homework, and then consult with the association’s attorney before signing off on any major contract or program. Those dollars spent in proactive decision making may well save thousands of dollars in legal fees at a later date.

“I think boards have to continuously evaluate the cost benefit analysis of getting involved in legal matters. They need to listen to their general counsel and property management,” says Hartwell. “I think boards need to be wary of non-objective advice. Boards need to oftentimes, stand back and separate the emotion from an issue and focus on business aspects. There are some boards where it becomes a war of roses. The boards have a lot more power because they get to expend the common funds on legal fees. And they will spend away. We’ve had cases that have gone on for six, seven years that have cost several hundred thousand dollars. Some boards are happy to go down that road right up until the point where it all ends.”

...But Just in Case

Legal pros agree that even the best-intentioned, most above-board board does occasionally make a mistake that results in legal action. One way to avoid compounding one blunder with another is to make certain your board is protected from mistakes made in good faith by carrying appropriate Directors & Officers (D&O) insurance, which protects board members and managers for their decisions.

Like all insurance policies, the coverage can get a little complicated. “It’s very broad,” says Steve Shappell, Esq., managing director of legal and claims practice for Aon Risk Solutions Financial Services Group, a national company which has several offices in Illinois and throughout the Midwest. “It’s an all-risk policy.”

Complicated or not, the truth is that nearly all directors and officers in every condo or HOA should have it, Shappell says. “I would guess that 95 percent of companies would have a really hard time getting directors and officers to serve for them if they didn’t get insurance,” he says. That’s because claims against directors and officers have been steadily increasing. According to a 2010 liability survey report by global consulting firm Towers Watson, 31 percent of all organizations can expect at least one claim made against their directors and officers each year. The bigger the organization, the more shareholders/residents, the more likely it is that a lawsuit will be brought against its decision-makers.

Without a D&O policy, the association or the cooperative may pay legal costs or damages directly from the funds of the corporation if necessary—and individual board members may pay directly from their own pockets. With judgments and settlements easily climbing into the millions, going D&O-less can be a devastating blunder.

In Closing

Experts note that boards should keep in mind that for most residents, their home is their most important investment. If a community association’s board takes action designed to protect the community, its homes, and its member’s financial interest, the board should expect to experience few problems. “Boards should have proper expectations,” says Hartwell. “If you want people to follow your rules, send the rules out so at least they’ll have the opportunity to read them and know what is expected of them. Mismatched expectations can be frustrating.”

Anne Childers is a freelance writer and a frequent contributor to The Chicagoland Cooperator. Staff writer Christy Smith-Sloman contributed to this article.

Comments

Leave a Comment