Chicagoans are a tough crowd. After all, it takes a hardened crew to be able to weather a Chicago winter that rivals its nickname as the Windy City.

But while many neighborhoods are starting to bounce back after the recession, some are still licking their wounds and attempting to make the best of those foreclosed homes on their streets and owner-turned-rental units in their buildings.

A look back at 2013 shows that Chicago is still struggling to regain what it lost, but it’s getting closer and the sellers now have a slight edge over the buyers—due mainly to low inventory.

From Bust to Boom Again

“The residential real estate market in Chicago has seen an upswing in the last few years,” says Vidya Anderson, a broker associate/realtor with Baird & Warner on the Gold Coast. “Transactions, whether buying or selling, are moving at breakneck speed due to several factors, including low inventory—and buyers are looking to purchase before mortgage interest rates continue to rise. Multiple offer situations have become commonplace, which puts sellers in the position of having buyers compete for their property.”

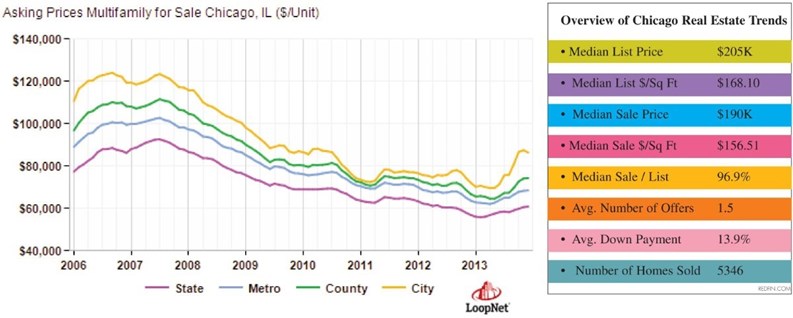

The statistics reflected Anderson’s observations. November 2013’s median list prices showed a 7 percent increase over the home prices for the same month in 2012, while the median age of inventory decreased 11 percent compared with last year’s levels, according to real estate market data and statistics compiled by Realtor.com.

In Chicago, the median list price for a home in November 2013 (December wasn’t available at press time) was $200,000, which was a 16 percent increase over prices at the same time last year, according to Realtor.com. There were 53,300 listings in the city—an 11 percent drop from this time in 2012.

According to the Chicago Association of Realtors, which tracks quarterly unit sales for the city of Chicago—in the past 21 years, there have only been five years with higher sale volume than 2013. And while 2013 sales were nowhere near the bubble of 2005, they’re starting to rapidly rise in that direction again. This all coincided with the lowest level of inventory on record since the data has been tracked.

Even foreclosures are trending downward, according to RealtyTrac data, which tracks foreclosures by month. The year 2012 saw more foreclosures than 2011, but they started to drop significantly by the beginning of 2013. In December 2013, only 33 percent of the Chicago-area sales were distressed—and that number is the lowest it’s been in the last five years.

“Gone are the liquidated properties—short sales and foreclosures which saturated the market a few years ago,” Anderson says.

These are all reasons why real estate agents and sellers are rejoicing—but this doesn’t mean that Chicago—and Illinois as a whole—has returned to the heyday of the early 2000s. “The market of the early 2000s was more of an anomaly in terms of its heat,” says Greg Jaroszewski, a real estate broker with Gagliardo Realty Associates, LLC in Oak Park. “Today’s market has educated buyers willing to wait for the right property—and, more importantly—to get the best value for what they spend.”

Anderson agrees, adding that the boom of the 2000’s changed Chicago to such an extent that the city is still recovering. “In the early 2000’s, developers were stuffing neighborhoods with new projects, buyers were paying high prices which they felt were justified and the Chicago housing market was booming,” she says. “Once the bubble burst, many of these developments were left struggling for occupancy. Contracts and lending fell through making invested buyers pull out. People were left owing significantly more on their mortgages than what their property was worth. Plots of land designated for new development were left vacant for years, as developers could no longer fund their promised projects.”

A Seller’s Market

Things are looking up for the sluggish Chicago real estate market, according to Crain’s Chicago Business. Among Chicago neighborhoods, prices are on the rise, with River North seeing the most improvement. A recent survey of 65 large downtown condo buildings found that resale prices on a square-foot basis in the second half of 2013 were just 6.3 percent below their peak in 2008. Prices in River North came back the most, at just 5.1 percent below their 2007 peak, followed by the Gold Coast, where prices were 6.3 percent below their 2007 peak, according to a survey by Appraisal Research Counselors, a Chicago-based consulting firm.

After plunging like the rest of the nation when the housing bubble burst, the Windy City’s downtown condo prices have been up over the past two years, driven by rising demand and falling supply. Resale prices at the buildings surveyed by Appraisal Research Counselors rose 9.3 percent in the second half of 2013 from the year earlier. The company’s survey covers more than 20,000 of the 70,000 or so condos in the greater downtown, an area bounded roughly by North Avenue, Cermak Road, Lake Michigan and Ashland Avenue. Nearly 1,300 condos in the area sold in the second half of 2013, up 8 percent from a year earlier and about the same as 2008. Today rather than vacancies, there is a shortage of units. Developers are sitting on just 498 unsold condos in downtown Chicago, down from more than 7,000 in 2007, according to Appraisal Research.

The low inventory means fewer choices for buyers and more leverage for sellers. “The arrow is definitely pointing up,” Sam Manzello, an agent at @properties who is selling a two-bedroom units at ParkView Condominiums in Streeterville that's listed for $859,000, told Crains. “With less inventory on the market, it's starting to stabilize.”

Even today—as Chicago is quickly becoming a great place to be a seller—it’s easy to see the damage that the so-called real estate boom did. “Simply by driving through many Chicago neighborhoods, you can see how many buildings that were slated to be condos with home ownership in mind have since become rental buildings after the recession,” Anderson says.

Still, Jaroszewski says, buyers are buying—and they’re now buying carefully and thoughtfully.

In Chicago and surrounding municipalities, he says, the buying spree picked up last year and is expected to continue to grow lest any unforeseen circumstances happen.

“We continue to see consumer confidence on the rise and interest rates remain low,” Jaroszewski says. “Should this trend continue, we anticipate a robust year in terms of units sold and stability of prices.”

Prices will not consistently go up—or stay stable across the board, however. Some neighborhoods are showing far more growth than others.

“In the traditionally good neighborhoods, the market is unbelievably hot,” says Jim Schueller, president of Bloomfield Development Company, LLC, an award-winning homebuilding and remodeling firm with projects throughout the Chicago area. “In the neighborhoods that were struggling during the recession—they’re still catching up.”

The neighborhoods that are doing the best are Lincoln Park and Lakeview, Schueller says. In the North Shore, the housing market is doing incredibly well, but in the far Northwest suburbs, it’s still a little slow, he says.

Type of Home Matters

Condos continue to lag behind in price appreciation, while single-family homes are jumping ahead and have reached heated levels and bidding wars, Jaroszewski says. While the condo prices will appreciate, they won’t do so at the same rate as the other housing.

Part of the reason for this is that condos are relatively easy to rent, so some condo owners are choosing to rent their homes rather than to sell and risk losing money at the moment.

“Condos provide an optimal vehicle for renters and unit owners who want to wait out the time for appreciation to occur,” Jaroszewski says. “Availability is likely to be plentiful. There is some concern about additional distressed inventory that may come on the market which will tend to have a downward effect on pricing.”

New construction, however, is incredibly hot at the moment, and has been for the past year, Schueller says.

“Guys like me who are trying to find land—it’s getting harder and harder,” Schueller says. “When a good property goes on the market for a teardown, multiple builders are bidding on it with cash.”

Once the builder finishes, he’s able to flip it quickly—and the buyers are open to pretty much anything at the moment.

“People are looking for location always and the schools,” Schueller says. “And beyond that, really, with new construction, there’s such a dearth of supply that the demand is strong for all types of new construction.”

Properties that are priced well will sell incredibly quickly—and have been doing well ever since the start of 2013. If they’re offered at a very good price, it’s likely that a bidding war will ensue.

“Although it can be a bit pressurizing for particular clients, like a first time homebuyer, being decisive and knowing the true value of what you want to buy is key to getting the home you want,” Anderson says. “It’s not pressure from your real estate agent—it’s market pressure. Desirable properties are gone in days. A property can become active on Monday and by Tuesday, there are three offers in.”

As to buying, selling and the real estate market in general in 2014 in Chicago and the surrounding municipalities? Expect more of the same as 2013—as long as the housing bubble continues to inflate and mortgage rates don’t suddenly rise and scare away anyone thinking of purchasing a home.

“Prices will continue to stabilize and creep upward, but I have doubts that we will see the kind of price inflation and buyer frenzy that was characteristic of the early 2000’s,” Jaroszewski says. “We are seeing some multiple offer situations again, but that is mostly attributable to the reduction in inventory and the laws of supply and demand.”

All in all, the Chicagoland real estate market seems to be more stable as buyers are buying again and sellers are getting to the price point they want to be.

Danielle Braff is a freelance writer and a frequent contributor to The Chicagoland Cooperator.

Leave a Comment